Property Tech Winter Is Over, But Climate Investment Struggles – Insights from Fifth Wall CEO

The property tech sector is rebounding after a tough few years, with big wins like ServiceTitan’s IPO signaling growth. However, climate tech in real estate faces challenges due to shifting U.S. politics, impacting sustainability efforts.

The PropTech Winter Has Thawed

Property technology, or proptech, makes real estate and property management easier through software and tools. But it’s had a rough ride. High interest rates, tight capital markets, and a venture capital shift to AI hit the sector hard. Brendan Wallace, CEO of Fifth Wall, a major venture capital firm managing over $3 billion, called it an “extinction event.” Many startups and funds didn’t survive.

Now, things are looking up. Last year, ServiceTitan, a cloud-based software for trades like plumbing and HVAC, raised $625 million in its IPO, with shares soaring 42% on debut. Bilt, a platform offering rent payment rewards, secured $250 million at a $10.75 billion valuation. These wins show proptech is creating value again after massive losses from 2022 to 2024.

The recovery means better tools for property managers, investors, and agents. Software that tracks payments, manages leases, or organizes workflows is in demand, helping professionals save time and build trust.

Climate Tech Faces Headwinds

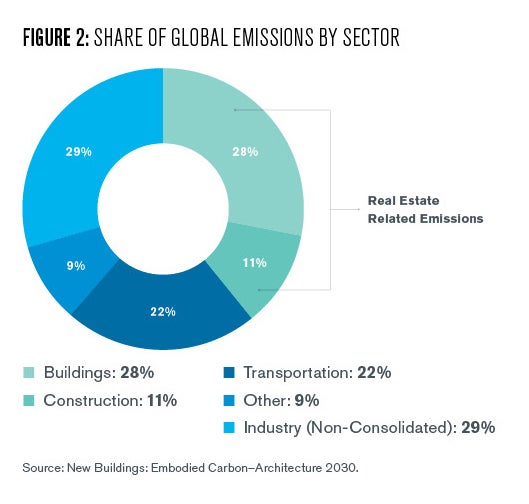

While general proptech is recovering, climate-focused tech in real estate is struggling. Real estate accounts for 40% of global carbon emissions, so green solutions are critical. But U.S. political shifts have cooled interest in sustainability, ESG (environmental, social, governance), and climate resilience.

Wallace notes that climate funds are finding it hard to raise money. Property owners are prioritizing less on decarbonization. Past public funding helped, but the sentiment has turned negative. This makes it tough for companies building tools to cut energy use or emissions.

However, local governments offer hope. Cities like New York are pushing carbon taxes to raise funds, which could boost demand for climate tech. These policies might drive innovation despite national challenges.

Opportunities in PropTech’s Future

Despite climate tech’s struggles, Wallace remains optimistic. Fifth Wall is investing now because valuations are low, offering big potential returns. Decarbonizing real estate will be costly, but that’s why capital will flow in over time.

The broader proptech sector is poised for growth. Flexible platforms that work for different roles—like agents, managers, or associations—are key. These tools help professionals adapt to market changes while maintaining efficiency.

For investors, the focus is on solutions that offer secure, transparent data and streamline operations. The recovery signals a chance to leverage tech for better outcomes in real estate.

Why This Matters for Real Estate Professionals

The proptech rebound offers tools that simplify complex tasks. For example, property managers can use software to handle tenant issues or track compliance. Investors benefit from platforms that provide reliable data for decision-making. Agents can automate listings to focus on clients.

Climate tech’s challenges don’t erase its importance. Local policies may push green solutions forward, especially in progressive cities. Professionals should watch these trends to stay ahead.

Key Takeaways from Fifth Wall’s Insights

PropTech Recovery: IPOs and funding rounds signal a strong comeback.

Climate Challenges: Political shifts make green tech funding harder.

Local Opportunities: Carbon taxes in cities could drive climate tech demand.

Tech’s Value: Flexible, secure tools are critical for real estate success.

Comments(0)